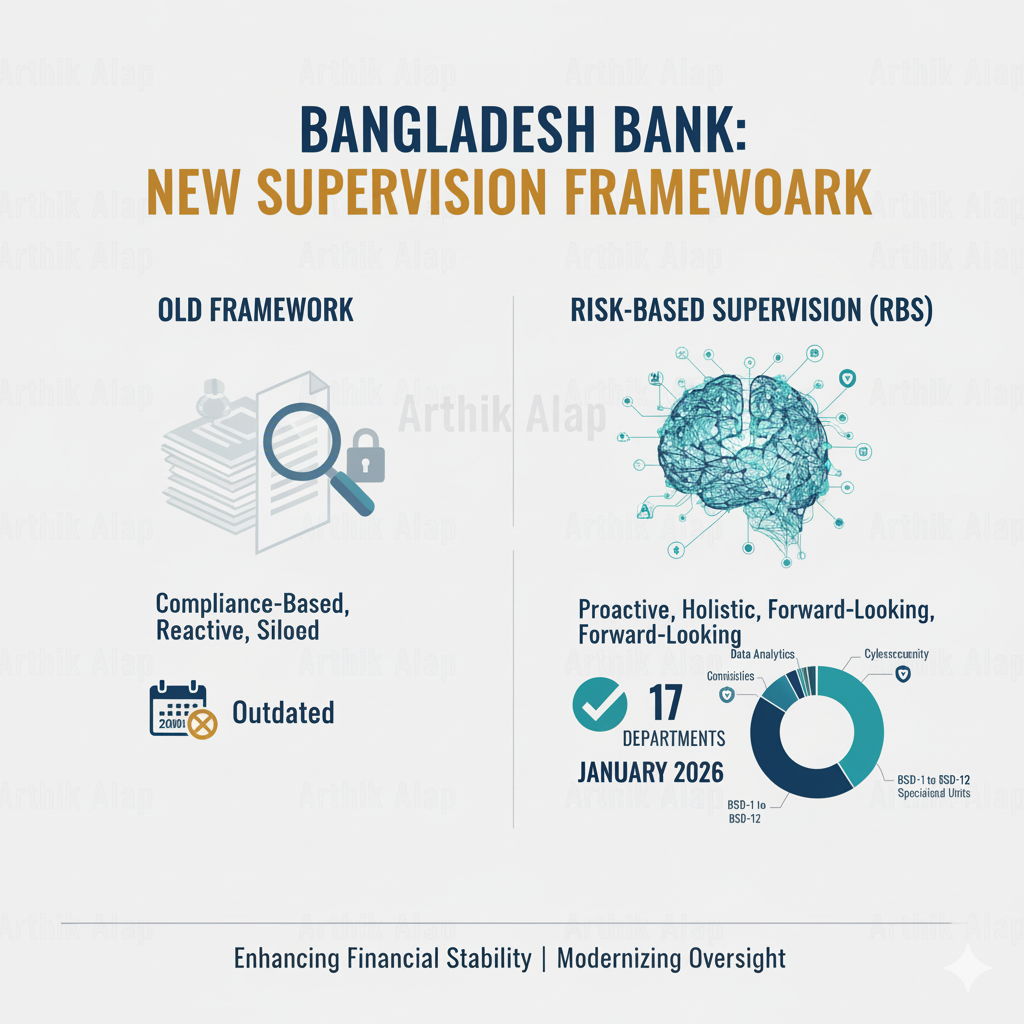

The Bangladesh Bank (BB) has officially issued a landmark framework for the transition to Risk-Based Supervision (RBS). Set to be fully operational from January 1, 2026, this shift marks the end of traditional compliance-based oversight in favor of a forward-looking, data-driven approach designed to safeguard financial stability.

1. Why the Shift? From Compliance to Risk-Based

Traditional supervision in Bangladesh was “compliance-based,” focusing on historical data and rule-checking. The new RBS framework addresses:

- Global Interconnectedness: Aligning with Basel III and international standards.

- Technological Advancement: Addressing digital banking and cybersecurity risks.

- Proactive Mitigation: Identifying risks before they lead to bank failure, rather than reacting after the fact.

2. Key Deadlines for Scheduled Banks

According to the SPCD Circular (October 23, 2025), all commercial banks must follow this strict readiness timeline:

| Deadline | Milestone / Task |

| October 2025 | Formation of a cross-functional RBS Coordination Committee. |

| November 2025 | Completion of Gap Analysis and Board-approved Action Plan. |

| December 2025 | Upgrading MIS and Data Systems to align with RIT templates. |

| January 1, 2026 | Official commencement of the RBS Supervisory Cycle. |

3. The New Supervisory Organogram

To support this framework, Bangladesh Bank has dissolved its old inspection departments and created 17 new supervisory departments.

Bank Supervision Departments (BSD-1 to BSD-12)

Each of these 12 departments is responsible for a dedicated set of banks. Every bank is assigned a Lead Bank Supervisor who serves as the single point of contact for:

- On-site and off-site monitoring.

- Foreign exchange and complaint management.

- Continuous risk profiling and intervention.

The 5 Specialized Supervisory Departments

- SDAD: (Supervisory Data Management and Analytics) – The hub for data validation and sectoral risk analysis.

- TRDS: (Technology Risk and Digital Banking) – Oversight of ICT, cyber-resilience, and digital banking.

- AMLD: (Anti-Money Laundering) – Focused strictly on ML/TF risks.

- PSSD: (Payment Systems) – Oversight of electronic and retail payment risks.

- SPCD: (Supervisory Policy and Coordination) – Managing the overall framework and policy alignment.

4. How Risks are Evaluated Under RBS

Supervisory assessments are now based on a structured evaluation of a bank’s Inherent Risks and Control Effectiveness.

Inherent Risk Categories:

- Financial Risks: Credit, Market, and Liquidity risks.

- Operational Risks: Technological, Legal, and Regulatory risks.

- Strategic Risks: Business model viability and reputation.

- ML/TF Risks: Vulnerabilities to financial crime.

Note for Bankers: Under RBS, the intensity of supervision is “proportionate.” Larger, more complex, or systemically important banks will face more frequent and deeper reviews than smaller institutions.

5. Strategic Benefits for the Banking Sector

- Elimination of Redundancy: A single data platform prevents the need for multiple submissions of the same data to different departments.

- Enhanced Risk Awareness: Promotes a “Prudent Risk Culture” from the Board of Directors down to branch staff.

- Sustainable Innovation: Supports the growth of digital banks while maintaining strict safety nets.

Frequently Asked Questions (FAQ)

What is the primary circular for RBS? The foundational guidelines are found in the SPCD Circular No. 02, issued on October 23, 2025.

Which banks are covered? All scheduled banks operating in Bangladesh, including state-owned, private, and foreign commercial banks.

How does RBS affect data reporting? Banks must use the Rationalized Input Template (RIT), shifting toward a unified data platform to ensure “evidence-based supervision.”

🏛️ RBS Readiness: A Strategic Checklist for Bank Boards

Under the SPCD Circular (Oct 23, 2025), the Board of Directors and Senior Management are held ultimately accountable for the transition to Risk-Based Supervision. Use this checklist to ensure your institution meets the 2026 compliance window.

Phase 1: Governance & Leadership (Deadline: October 2025)

- [ ] Form RBS Coordination Committee: Establish a cross-functional team led by a senior executive (e.g., CRO or AMD) to manage the transition.

- [ ] Define Risk Appetite: Review and approve an updated Risk Appetite Statement (RAS) that aligns with the new RBS scoring framework.

- [ ] Board Training: Schedule specialized awareness programs for Board members to understand the shift from “tick-box” compliance to “forward-looking” risk assessment.

Phase 2: Diagnostic & Action Planning (Deadline: November 2025)

- [ ] Gap Analysis: Conduct a “Readiness Diagnostic” to identify gaps in your current risk management, internal controls, and data infrastructure.

- [ ] Approve Action Plan: The Board must formally approve a structured Bank-Specific Action Plan to address identified gaps, with clear milestones and assigned accountabilities.

- [ ] Culture Assessment: Evaluate the bank’s internal “Risk Culture.” Bangladesh Bank now expects a culture of transparency where staff are incentivized to report risks early.

Phase 3: Systems & Data Integration (Deadline: December 2025)

- [ ] MIS Upgradation: Upgrade Management Information Systems to support the Rationalized Input Template (RIT). Data must be granular, accurate, and submitted via a single platform.

- [ ] Policy Documentation: Update all internal manuals, Standard Operating Procedures (SOPs), and internal control frameworks to reflect the RBS “Inherent Risk” categories.

- [ ] Emerging Risk Integration: Ensure the Risk Management Framework now explicitly includes Cyber Risk, Climate Risk, and Fintech-related risks.

Phase 4: Full Implementation (Launch: January 1, 2026)

- [ ] Single Interface Readiness: Prepare for the Lead Bank Supervisor (LBS). All communication with Bangladesh Bank must now be coordinated through a central supervisory point.

- [ ] Continuous Monitoring: Shift internal audit focus from periodic “snapshot” reviews to continuous, risk-focused monitoring.

📊 Comparison: Traditional vs. New RBS Framework

To rank well, your article must highlight the fundamental shift in how Bangladesh Bank (BB) will now monitor the industry.

| Feature | Traditional Framework (Old) | RBS Framework (New 2026) |

| Approach | Compliance-Based: Rule-checking & historical data. | Risk-Based: Forward-looking & process-focused. |

| Intervention | Reactive: Fixing problems after they occur. | Proactive: Identifying risks before they become systemic. |

| Structure | Inspection & Function-based (Siloed). | Integrated (Holistic bank-specific teams). |

| Intensity | “One-size-fits-all” for all banks. | Proportionate to size, complexity, and risk profile. |

| Data Hub | Fragmented reporting to various departments. | Centralized Platform (Unified Data Consolidation). |

🏗️ The Restructured Supervisory Organogram

Bangladesh Bank has replaced the old Department of Banking Inspection (DBI) and Department of Off-Site Supervision (DOS) with a streamlined 17-department structure.

12 Bank Supervision Departments (BSD-1 to BSD-12)

These departments now act as a “Single-Point Interface.” Instead of a bank talking to five different inspectors, they talk to one Lead Bank Supervisor within their assigned BSD.

- Mission: Continuous off-site and on-site monitoring under one roof.

- Goal: To maintain a 360-degree “Risk Profile” for every scheduled bank.

5 Specialized Supervisory Departments

These departments provide cross-cutting expertise to the 12 BSDs:

- SDAD (Supervisory Data Management and Analytics): The “Engine Room.” It collects and validates all supervisory data via the RIT platform.

- TRDS (Technology Risk and Digital Banking Supervision): Monitors ICT risks, cyber-resilience, and the safety of new digital banking products.

- AMLD (Anti-Money Laundering & Terrorist Financing): Focused on financial crime risks and compliance with FATF standards.

- PSSD (Payment Systems Supervision): Monitors the risks associated with RTGS, BEFTN, and other retail payment infrastructures.

- SPCD (Supervisory Policy and Coordination): The “Brain.” It manages the overall RBS policy and ensures coordination between the 17 departments.

“The transition to RBS is not just a change in forms—it is a change in culture. By January 2026, Bangladesh Bank expects commercial banks to move from simply ‘following rules’ to ‘managing risks’ proactively. This restructuring into 17 specialized departments is the most significant regulatory overhaul in BB’s history, designed to bring the Dhaka financial market into alignment with global Basel III standards.”