The Truth Behind Non-Performing Loans and the Recovery Roadmap

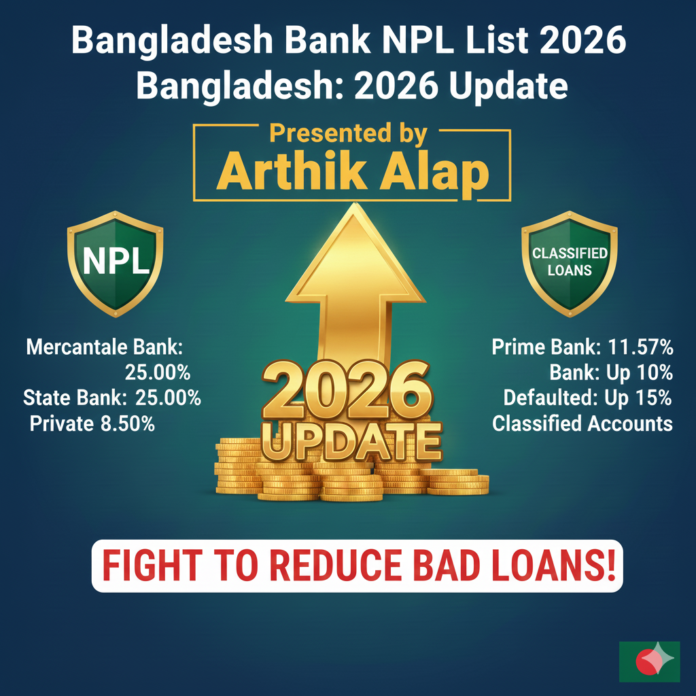

As we enter 2026, the Bangladesh banking sector is at a crossroads. Following the massive “Asset Quality Reviews” (AQR) of 2025, the reported volume of Non-Performing Loans (NPLs) has reached an unprecedented peak. What was once hidden under the rug of rescheduling is now fully visible on bank balance sheets.

For Arthik Alap readers, understanding this “cleaning process” is vital to knowing which banks are truly stable and which are struggling to survive.

1. The Shocking Reality: NPL Data for 2026

In late 2025, NPLs in Bangladesh hit a record 35.73% of total disbursed loans, totaling over BDT 6.44 trillion. This surge was primarily due to:

- Stricter Audit Standards: Independent global firms (like KPMG and EY) conducted AQRs, exposing hidden defaults.

- New Classification Rules: Bangladesh Bank now classifies a loan as “Sub-standard” if an installment is overdue for just 3 months, aligning with international Basel III standards.

2. Bangladesh Bank’s NPL Recovery Roadmap

To save the sector, the central bank has set a rigorous June 2026 deadline to bring these numbers down.

| Bank Category | Current NPL (Estimated) | June 2026 Target |

| State-Owned Banks (SOBs) | 32.7% | Below 10% |

| Private Commercial Banks | 15% – 20% | Below 5% |

| Overall Industry Average | 35.7% | Below 8% |

3. Major Policy Changes in 2026

The recovery strategy isn’t just about asking for money; it’s about structural change:

- The 2-Year Write-Off Rule: Banks can now write off bad loans after 2 years instead of 3, provided they have 100% provisioning. This helps “beautify” the balance sheet while legal battles continue.

- Write-Off Recovery Units: Every bank must now have a dedicated recovery unit supervised directly by the Managing Director (MD). Recovery performance now directly impacts the MD’s salary and bonus.

- Partial Write-Offs: For the first time, banks are allowed “partial write-offs” based on collateral value, allowing them to settle parts of a debt to keep businesses running.

4. Rescheduling and the “Exit Policy”

For 2026, Bangladesh Bank has introduced a “Golden Exit” for genuine businesses:

- Down Payment: Borrowers can reschedule defaulted loans with only a 2% down payment.

- Tenure: Up to 10 years for repayment with a 2-year grace period.

- Benefit: Once a borrower opts for this, their status is immediately upgraded to “Unclassified,” allowing them to open new LCs (non-funded facilities) to restart their business.

5. Mergers and Insolvent Banks

As of early 2026, several “Red Zone” banks are undergoing forced mergers or restructuring. The Bank Resolution Ordinance 2025 allows the government to create “Bridge Banks” to protect depositors of banks that have failed the AQR test.

🛡️ How to Protect Your Deposits

If your bank has an NPL ratio higher than 15%, it is considered high risk. Arthik Alap recommends moving significant savings to banks with NPLs below 5% (mostly foreign banks and top-tier private banks like BRAC, EBL, or Prime Bank).